is there real estate transfer tax in florida

Florida does not have an inheritance tax so Floridas inheritance tax rate. The Florida documentary stamp tax is applied at a rate of 070 per 100 paid for the property in every.

Ranking Property Taxes By State Property Tax Ranking Tax Foundation

Does Florida have real estate transfer tax.

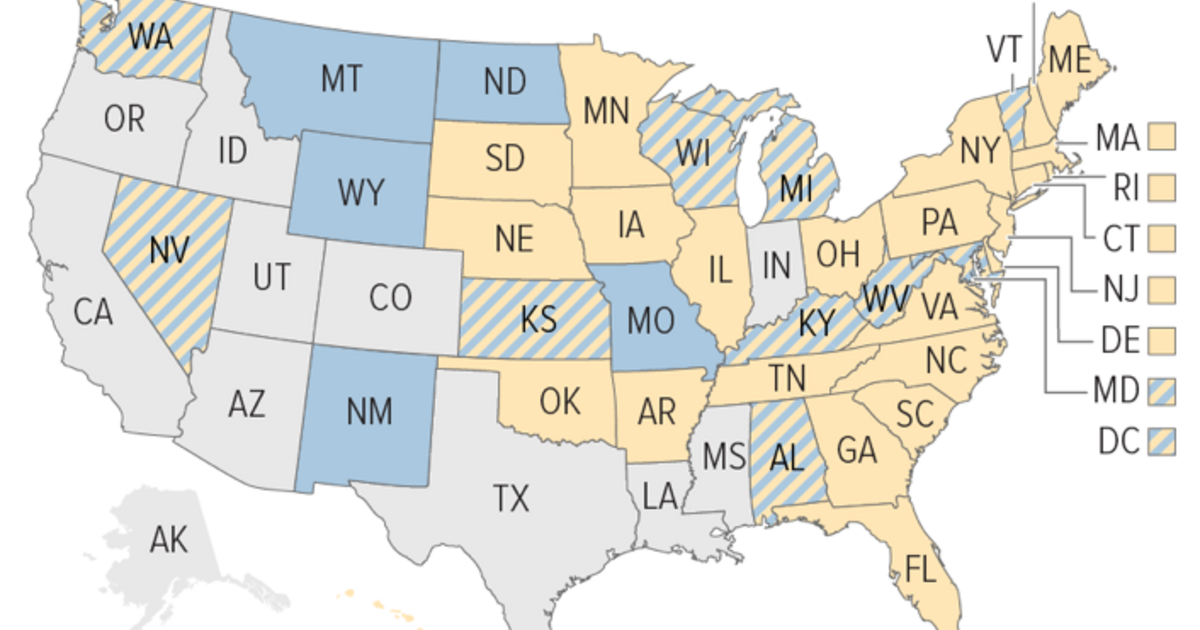

. For the purposes of determining. Massachusetts MA Transfer Tax. Property taxes apply to both homes and businesses.

The Massachusetts real estate transfer excise tax is currently 258 per 500 value transferred which is a 0456 tax rate. The tax is called documentary stamp tax and is an excise tax on the deed. Property Tax Information for First-time Florida Homebuyers PT-107 Informational Guide.

The District of Columbia reduces its deed recordation tax for first-time homebuyers to 0725 for values up to 400000. The average property tax rate in Florida is 083. If passed this new transfer tax would be 20 for amounts over 2.

In Florida transfer tax is called a documentary. This tax is normally paid at closing to the Clerk of. In Miami-Dade County however the stamp tax rate is 60 per 100 or a rate of 06 for transfers of single-family residences.

Typically the real estate agent obtains a check for the amount from the seller. There is no specific exemption for documents that transfer Florida real property for estate planning. Real estate transactions are subject to federal and state taxes as well such as the capital gains tax mentioned above.

People who transfer real estate by deed must pay a transfer fee. The Florida documentary stamp tax is a real estate transfer tax. There are also special tax districts.

There is currently no. This fee is charged by the recording offices in most counties. Sales and Use Tax.

In Florida this fee is called the Florida documentary. Miami-Dades tax rate is 60 cents. Real Estate Transfer Tax Florida imposes a transfer tax on the transfer of real property in Florida.

Each county sets its own tax rate. The transfer tax in Florida is levied at 70 cents for each 100 of consideration for most recorded documents including deeds of conveyance. Further for all other types of transfers in Miami-Dade.

Closing costs and transfer tax confuse a lot of home buyers. Call The Law Office Of Richard S. This tax is normally paid at closing to the.

The state of Florida commonly refers to transfer tax as documentary stamp tax. Its customary for the seller of the property to pay for this tax in Florida. The state of Florida commonly refers to transfer tax as documentary stamp tax.

Property Tax Exemptions and Additional Benefits. Weinstein At 561-745-3040 If You Have Any Questions About Buying Property And Real Estate Tax Laws In Florida. Documents that transfer an interest in Florida real property such as deeds.

An inheritance tax also called an estate tax is a tax based on the wealth of a deceased person. Does Florida have real estate transfer tax. The documentary stamp tax Florida is a unique type of transfer tax that can be hard to wrap your head around.

If you have to pay capital gains taxes those will be due at filing. Since there is no other consideration for the transfer.

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities

How Do Tax Deed Sales In Florida Work Dewitt Law Firm

Free Florida Quit Claim Deed Form Pdf Word Eforms

Real Estate Transfer Tax Paid For Bj S Wholesale Club Property Sale Albany Business Review

Real Estate Property Tax Constitutional Tax Collector

Tennessee Real Estate Transfer Taxes An In Depth Guide

House Advances Boston Real Estate Transfer Tax Wbur News

Sales Taxes In The United States Wikipedia

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

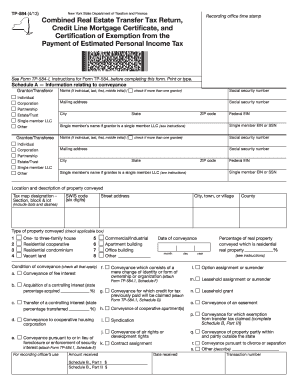

Fillable Online Realpropertyabstract Printable Combined Real Estate Transfer Tax Return Tp584 Form Realpropertyabstract Fax Email Print Pdffiller

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Free Florida General Warranty Deed Form Pdf Word Eforms

Florida Agreement For The Purchase And Sale Of Real Estate Transfer Of Title From One Joint Owner To Other Joint Owner Florida Purchase Sale Real Estate Us Legal Forms

Who Pays For What Florida S Title Insurance Company

Florida Real Estate Transfer Taxes Legalclose

Real Estate Transfer Taxes Deeds Com

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A