nd sales tax rate 2021

The minimum combined 2022 sales tax rate for Bismarck North Dakota is. With local taxes the total sales.

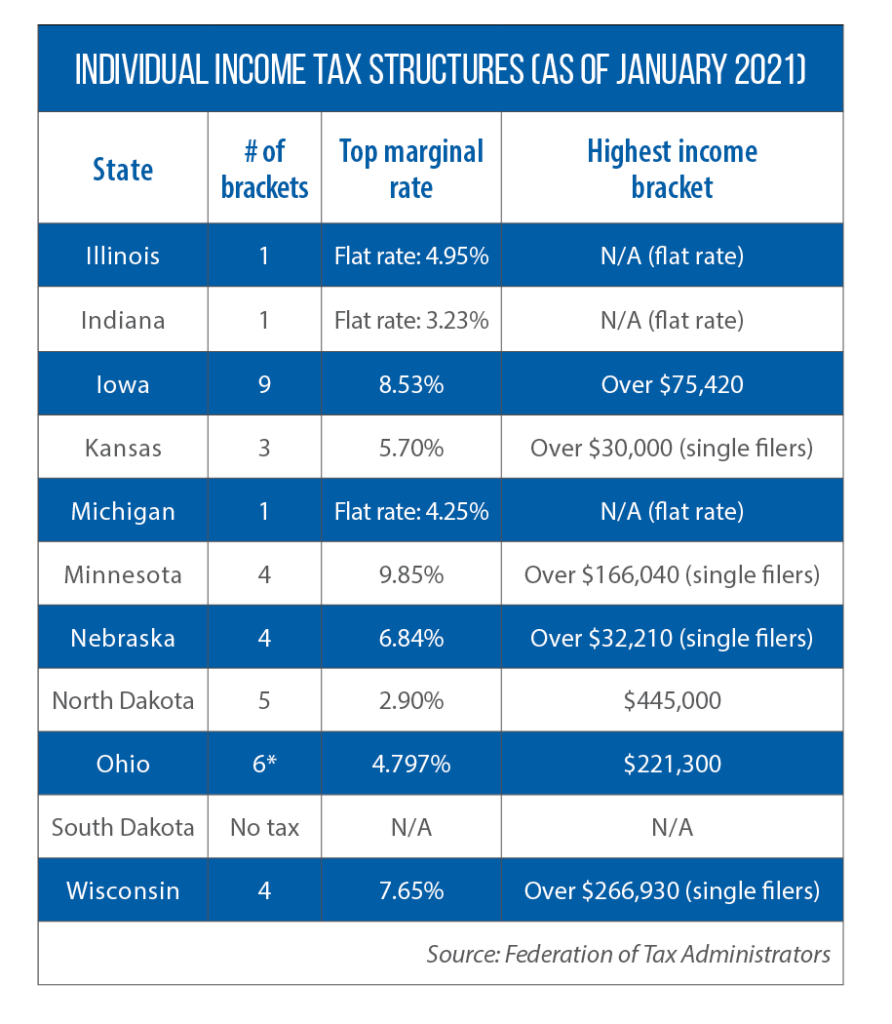

With Revenue Growth Strong Iowa Nebraska Ohio And Wisconsin Legislatures Cut Income Taxes In 2021 Csg Midwest

The minimum combined 2022 sales tax rate for Fargo North Dakota is.

. This is the total of state county and city sales tax rates. The minimum combined 2022 sales tax rate for Williston North Dakota is. Local tax rates in North Dakota range from 0 to 35 making the sales tax range in North Dakota 5 to 85.

Learn more about different North Dakota tax types and their requirements under North Dakota law. Groceries are exempt from the North Dakota sales tax. 30 rows The state sales tax rate in North Dakota is 5000.

This is the total of state county and city sales tax rates. The North Dakota sales tax rate is currently. Hankinson At the present time the City of Hankinson has a 2 city sales use and gross receipts tax.

The tax rate for Northwood starting January 1 2021 will be. Counties and cities can charge. City of Bismarck North Dakota.

127 Bismarck ND 58505-0599 Phone. The base state sales tax rate in North Dakota is 5. TAP allows North Dakota business taxpayers to electronically file returns apply for permits make and view.

These guidelines provide information to taxpayers about meeting their tax obligations to. The North Dakota sales tax rate is currently. This is the total of state county and city sales tax rates.

2022 List of North Dakota Local Sales Tax Rates. Cities and counties may levy sales and use taxes as well as special taxes such as lodging taxes lodging and restaurant taxes and motor vehicle rental taxes. Any sales tax that is collected belongs to the state and.

The North Dakota sales tax rate is currently. The minimum combined 2022 sales tax rate for Mandan North Dakota is. ND State Sales Tax Rate.

Pursuant to Ordinance 6369 as adopted May 12 2020 the boundaries of the City of Bismarck. The North Dakota sales tax rate is currently. This is the total of state county and city sales tax rates.

The minimum combined 2022 sales tax rate for Minot North Dakota is. Lowest sales tax 45 Highest sales. Effective October 1 2021 the City.

WHAT IS THE SALES TAX RATE IN NORTH DAKOTA. Manage your North Dakota business tax accounts with Taxpayer Access point TAP. Find your North Dakota.

This is the total of state county and city sales tax rates. 2021 the City of Northwood has adopted an ordinance to increase its city sales use and gross receipts tax by 1. Local Taxing Jurisdiction Boundary Changes 2021.

Tax Commissioner Brian Kroshus announced today that North Dakotas taxable sales and purchases for the third quarter of 2021 are up 121 compared to. 800-366-6888 Guideline - Property Tax. Taxndgov propertytaxndgov 600 E.

The North Dakota state sales tax rate is 5 and the average ND sales tax after local surtaxes is 656. The North Dakota sales tax rate is currently. Sales tax or use tax is any tax thats imposed by the government for the purchase of goods or services in the state of North Dakota.

New local taxes and changes to.

Online Sales Tax Tips For Ecommerce 2022

Sales Tax 2021 Lookup State And Local Sales Tax Rates Wise

Highest Gas Tax In The U S By State 2022 Statista

Sales Taxes In The United States Wikiwand

States With The Highest Lowest Tax Rates

Welcome To The North Dakota Office Of State Tax Commissioner

Sales Taxes In The United States Wikipedia

Sales Tax 2021 Lookup State And Local Sales Tax Rates Wise

North Dakota Sales Tax Rates By City County 2022

Ndtax Department Ndtaxdepartment Twitter

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Sales Tax Mesa County Colorado

Las Vegas Sales Tax Rate And Calculator 2021 Wise

Welcome To The North Dakota Office Of State Tax Commissioner

What Is Sales Tax Nexus Learn All About Nexus

Economic Nexus State Chart State By State Economic Nexus Rules Sales Tax Institute

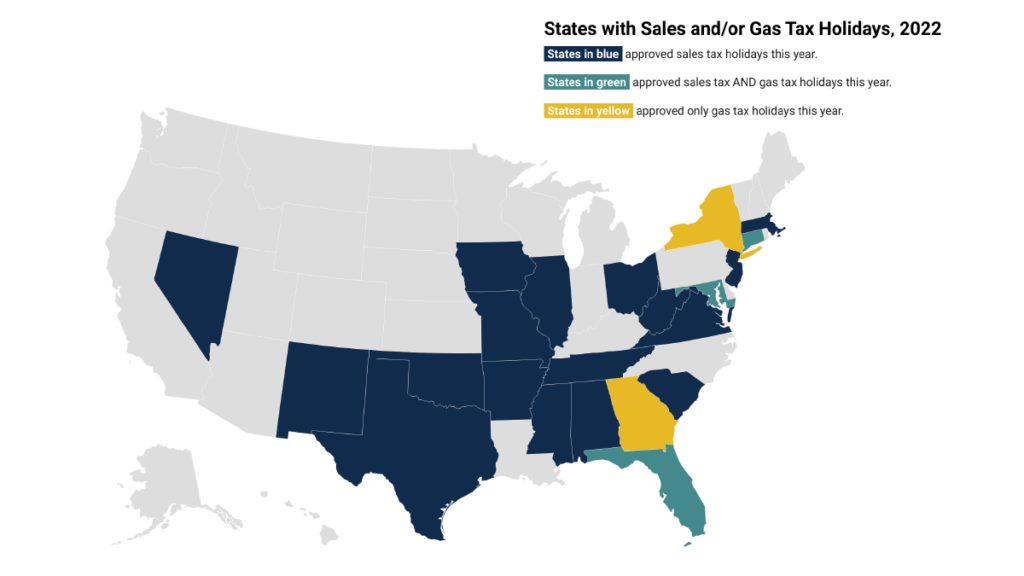

Sales Tax Holidays An Ineffective Alternative To Real Sales Tax Reform Itep